Did you know that only 21% of working Americans feel "very confident" they’ll retire comfortably? That surprising figure highlights a sobering truth: building retirement wealth isn’t just a lofty goal—it’s a necessity. If you’re worried about your retirement plan or feel behind in saving and investing, you’re not alone. By the end of this guide, you’ll discover the essential strategies that can help you build wealth for retirement, protect your family’s future, and finally feel confident about your financial plan.

Unlocking the Secret to Building Retirement Wealth: Why Most Americans Fall Short

Building retirement wealth starts with understanding why so many Americans struggle. Despite widespread access to financial planning tools and employer-sponsored retirement plans, millions still fall short of their financial goal. The root cause is often a combination of late or inconsistent saving, lack of a clear retirement plan, and misunderstanding how much retirement income is truly needed to maintain a desirable lifestyle. Many workers underestimate expenses, or assume that Social Security alone will suffice, often overlooking the power of mutual funds, Roth IRA, or life insurance in securing reliable streams of retirement income.

Ultimately, it takes more than good intentions—you need a concrete strategy. To build wealth for retirement, you must align your financial plan with both short- and long-term goals, integrate investment advice from reliable sources, and start saving and investing as soon as possible. Let’s examine just how widespread the challenges are with some eye-opening retirement savings statistics.

A Surprising Retirement Planning Statistic

- Only 21% of workers feel ‘very confident’ in their ability to fully retire comfortably.

- Median retirement savings by age 50 is less than $150,000.

- 1 in 3 adults have no retirement plan at all.

Defining Building Retirement Wealth: Your Roadmap to Financial Freedom

When we talk about building retirement wealth , we’re referring to more than simply stashing away money in a savings account. The right approach requires an intentional financial plan, a diversified investment portfolio, and steady growth strategies that adapt over time. Your retirement plan must go beyond setting a single savings goal—it’s about orchestrating various sources of potential retirement income, including employer plans, Social Security, mutual funds, and IRAs, to work together in your favor.

True wealth management for the future means you stop wondering if you’ll have enough and start taking control. By understanding the difference between mere retirement savings and generating sustainable retirement income, you position yourself for financial independence and peace of mind.

What Does Building Retirement Wealth Really Mean?

- Why focusing on building wealth for retirement is essential

- The difference between retirement income and retirement savings

It’s critical to distinguish retirement savings —the total amount you've set aside—from retirement income , which is the money you’ll draw each month after leaving the workforce. Building wealth means consistently increasing your investment portfolio so your assets generate income and grow over time. Utilizing a retirement plan that incorporates Roth IRA or mutual fund strategies does more than provide tax advantages; it supports your ability to build and sustain wealth, helping your nest egg outpace inflation and rising living costs.

This distinction is vital since your focus should shift from simply accumulating a lump sum to creating a sustainable stream of ordinary income. With the right financial plan, your investment adviser can help you maximize wealth throughout your working years and well into retirement.

Setting a Clear Financial Goal for Retirement

- The impact of a financial plan on your retirement journey

- Importance of a documented retirement plan

A strong financial plan starts with setting a well-defined financial goal. Not only does this provide motivation, but it also allows you to map out the saving and investing milestones necessary to reach your vision for retirement. Whether you want a certain retirement income, to pay off all debt, or to travel freely, you must quantify your targets and document them in a retirement plan.

Research shows that individuals with a documented financial plan accumulate considerably more wealth. Goals are not just aspirations—they are statistics-backed predictors of success in building retirement wealth. A written plan makes you more accountable, helps you monitor progress, and allows for adjustments as your circumstances or retirement planning objectives change.

How to Start Saving: The Core Strategy for Building Retirement Wealth

The foundation of any solid approach to building retirement wealth begins with one simple rule: start saving early. Even modest monthly contributions can compound significantly over time, especially when invested wisely through mutual funds or a Roth IRA. Early savers benefit from compound interest, which means their money works harder and faster toward the financial goal of sustainable retirement income.

Set yourself up for success by opening suitable retirement accounts early—either through employer-sponsored plans like a 401(k) or an Individual Retirement Account (IRA). Remember, when it comes to building wealth, nothing substitutes for the head start you gain by getting serious about saving and investing now.

As you consider the best ways to protect your retirement savings and ensure your loved ones are financially secure, it's also wise to explore how final expense insurance can complement your overall plan. For those residing in the region, a Massachusetts final expense consultation can provide valuable insights into safeguarding your legacy and covering end-of-life costs as part of a comprehensive retirement strategy.

Why You Must Start Saving Early

- Compound interest as your most powerful ally

- Retirement planning timelines and milestones

Starting to save for retirement in your 20s or 30s means you can leverage compound interest to its fullest potential. Compound interest is the process where your investment earnings (interest, dividends, or capital gains) are reinvested, generating even more earnings. The longer your money is invested, the more exponential your wealth growth will be. By setting a reachable savings goal early on—no matter how small—you set the stage for financial security that grows each decade.

Missing out on this early compounding power can add decades to your working life. That’s why so many investment advisers stress the importance of beginning your retirement savings journey as soon as possible. Waiting to start saving only makes reaching your financial plan more challenging, often requiring either much larger monthly contributions or trade-offs on your lifestyle goals later in life.

Setting Up Your Retirement Savings Plan

- IRAs (Roth IRA & Traditional): Benefits and differences

- Employer-sponsored retirement plans such as 401(k)

There are several types of retirement accounts, each with unique advantages. The Traditional IRA lets you reduce your taxable income during your working years, while a Roth IRA enables tax-free withdrawals in retirement. Choosing between a traditional ira and a Roth ira often comes down to your current and future tax bracket, as well as your overall investment strategy.

Employer-sponsored plans like the 401(k) permit larger contributions and frequently offer employer matching—effectively free money to help you build wealth. By utilizing these plans, especially if you start saving early and take advantage of all possible matches, you can grow your nest egg without even needing deep investment experience. If you’re unsure which retirement plan is best, a financial adviser can help tailor your selection to fit your career path and financial goal.

Key Tools for Building Retirement Wealth: Investments and Beyond

To accelerate building retirement wealth, you need more than just a savings account. Today’s most effective retirement plans are powered by a mix of mutual funds, diversified portfolios, Roth IRAs, and carefully-timed Social Security strategies. Integrating these tools as part of wealth management can provide greater returns, cushion against market volatility, and increase the odds you’ll reach your desired retirement income.

Let’s break down how specific investments and financial products can support your journey to building wealth for retirement.

Mutual Funds and Diversified Portfolios

- How mutual funds can help build wealth over time

- Explaining target-date funds as part of a retirement plan

Mutual funds pool money from different investors to purchase a broad mix of stocks, bonds, or other securities. By using mutual funds—and especially by choosing target-date funds that automatically adjust to become more conservative as you approach retirement—you ensure your investment portfolio remains balanced and responsive to shifting market conditions.

Diversification is the mantra of effective investment planning: spreading your money across a variety of assets helps mitigate risk, enhance stability, and position you for steady growth. A financial advisor or investment adviser can guide you in choosing the optimal mix based on your retirement plan and risk tolerance, ensuring your long-term plan to build wealth stays resilient.

Roth IRA: Tax-Advantaged Growth for Retirement Income

- Eligibility and contribution limits

- Potential for tax-free retirement income

Roth IRA accounts are a cornerstone of modern retirement planning, offering unique advantages for building retirement wealth. Contributions are made with after-tax dollars, but your withdrawals in retirement—including all investment growth—are tax-free, provided you follow basic rules. Eligibility for Roth IRA depends on your income level, and contribution limits may change annually, so it’s important to stay updated or consult reliable tax advice.

The possibility of tax-free income in retirement is especially attractive if you expect to be in a higher tax bracket or want to minimize your ordinary income taxes later in life. Incorporate Roth IRA as a fundamental pillar of your retirement plan to maximize future flexibility and reduce the uncertainty in planning your retirement income.

Balancing Life Insurance with Retirement Planning

- Life insurance as protection for your financial plan

- When to integrate life insurance into a retirement plan

Life insurance, when paired with your retirement savings plan, serves as a crucial safety net. While not a direct investment, it guarantees that your loved ones remain financially secure should unforeseen events disrupt your retirement plan. Depending on your circumstances, permanent life insurance policies (like whole or universal life) even build cash value over time, providing another source of building wealth or emergency funds in retirement.

Financial goals and family needs evolve, so periodic review is key. Consider discussing with a knowledgeable investment adviser about when life insurance should be integrated into your broader plan for building retirement wealth. It’s a layer of security many overlook until it’s too late.

Social Security: Role in Retirement Planning

- Understanding Social Security as a retirement income stream

- When should you start receiving benefits?

Social Security is designed to replace a portion of your pre-retirement income based on your top earning years. For many, it’s a critical component of their retirement income, but it’s usually not enough to cover all monthly expenses on its own. Deciding when to start benefits—whether at the earliest eligible age of 62, full retirement age, or even delaying to 70 for larger payments—depends on your health, lifestyle, and broader financial plan.

Integrating your estimated Social Security benefits with your investment strategy, Roth IRA withdrawals, and mutual funds allows for a smoother transition into retirement, providing multiple safety nets for your overall retirement plan. Don’t overlook Social Security when building your comprehensive retirement income roadmap.

Retirement Planning Essentials: Building Wealth for Every Life Stage

The approach to building retirement wealth isn’t one-size-fits-all. As you move through different life stages—your 20s, 30s, 40s, 50s, and beyond—your financial plan, savings goal, and investment strategy should evolve.

Let’s look at how to build wealth for retirement at each crucial milestone, optimizing your plan according to where you are now and where you want to be.

Building Wealth in Your 20s and 30s

- How to start investing and saving for retirement early

- The impact of employer-sponsored plans

If you’re in your 20s or 30s, starting with even a modest monthly contribution to your retirement savings can set you on the path to long-term wealth. Compound interest and market growth are greatest over extended periods, meaning your early efforts in 401(k)s, Roth IRA, or mutual funds can yield extraordinary results by the time you approach retirement.

Take advantage of employer-sponsored plans immediately, especially if there’s a matching contribution. The earlier you automate savings, the less you’ll feel the pinch, and the more flexibility you’ll have later for larger expenses or life events. Eventually, you’ll want to diversify investments, but consistency and starting early are the building blocks of your financial goal.

Wealth Building in Your 40s and 50s

- Catch-up contributions explained

- Adjusting your financial plan as retirement nears

In your 40s and 50s, your strategy should shift towards maximizing contributions—especially taking advantage of catch-up contributions allowed by the IRS for those 50 and over. These additional savings bolster your retirement plan during prime earning years, compensating if you started late or want to further build wealth.

This is also the time to review your investment portfolio for appropriate risk. You may want to gradually shift some assets into less volatile or fixed-income types of investment, protecting your gains and preserving capital. Schedule regular reviews with your financial advisor to keep your financial plan aligned with your changing life and long-term goals.

Approaching Retirement: Building and Preserving Retirement Wealth

- Transitioning from building wealth to protecting wealth

- Creating reliable streams of retirement income

Nearing or entering retirement means switching focus from accumulating assets to establishing stable, reliable retirement income. This is where a robust mix of mutual funds, Roth IRA withdrawals, Social Security, and possibly annuities come into play. It’s essential to ensure you have a steady stream that can cover your monthly expenses, protect against inflation, and buffer unexpected events such as healthcare needs.

As you approach retirement, review your life insurance coverage, update beneficiaries, and reallocate investments to reduce risk. If possible, consult a wealth management professional to map out income withdrawal strategies and to check if your current retirement savings can meet your lifestyle expectations for the decades ahead.

How Much Retirement Income Do You Need When Building Retirement Wealth?

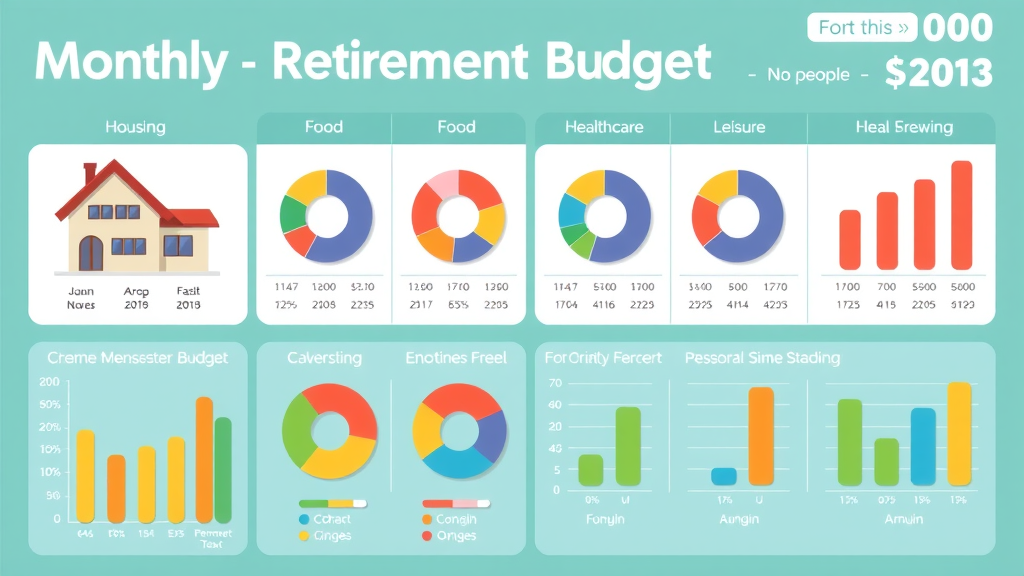

Determining your needed retirement income is one of the most important—yet personal—questions when building retirement wealth. Your number will depend on your desired lifestyle, anticipated expenses (housing, healthcare, leisure, etc.), and where you’ll live. Tools like retirement income calculators help you set a more accurate financial goal based on these factors.

Popular benchmarks, such as the $1000-a-month rule or the “replace 70%-80% of pre-retirement income” guideline, offer a baseline. However, you must personalize these formulas for your own retirement plan, factoring in ordinary income from investments, Social Security, and other sources to close any gaps.

Understanding Income Needs and the $1000-a-Month Rule

- Using retirement income calculators

- The relationship between lifestyle and financial goals

The $1000-a-month rule is a simple guide: for every $1000 in monthly income you want during retirement, you typically need to save about $300,000 (using the 4% withdrawal rule). Calculators that model your monthly expenses, expected retirement account returns, and Social Security benefits can help you see if your current savings goal is realistic.

Remember, living costs vary widely by location and health status. Clarifying your lifestyle goals early enables better planning, helping you build wealth to meet actual needs and avoid surprises as your retirement approaches.

Is $4000 a Month Enough for a Comfortable Retirement Income?

- Assessing your retirement plan’s adequacy

- Regional and lifestyle factors

Is $4000 a month sufficient for a comfortable retirement? For some, it’s more than enough; for others living in high-cost areas, it may fall short. Take a proactive approach by documenting and tracking monthly expenses, then comparing them with your projected retirement income—factoring in housing, food, healthcare, leisure, and contingencies.

It’s smart to review your retirement plan annually and adjust your savings, investment strategy, or expected lifestyle as your needs and circumstances change. Flexibility in your financial goal helps you keep pace and pivot when life takes an unexpected turn.

| Budget Level | Housing | Food | Healthcare | Leisure | Other | Total |

|---|---|---|---|---|---|---|

| $1,000 | $400 | $150 | $100 | $75 | $275 | $1,000 |

| $2,000 | $700 | $300 | $200 | $200 | $600 | $2,000 |

| $4,000 | $1,200 | $500 | $400 | $600 | $1,300 | $4,000 |

| $7,000+ | $2,100 | $800 | $700 | $1,200 | $2,200 | $7,000+ |

The Best Ways to Build Wealth for Retirement: Proven Strategies

Ready to put your plan in motion? The best approaches to building retirement wealth are proven, simple to implement, and scalable no matter your current financial situation.

Let’s review the top strategies, from automating savings to optimizing employer retirement plan contributions and diversifying your investment strategy for reliable long-term income.

Automating Savings—Start Saving Without Thinking

- Setting up automatic monthly transfers to your retirement savings account

- Dollar-cost averaging with mutual funds or ETFs

Automation takes discipline out of the equation. By establishing automatic monthly transfers to your Roth IRA or employer retirement plan, you guarantee regular saving, supporting your overall financial plan even on hectic months. This “pay yourself first” habit turns building wealth into a background process, keeping you consistent regardless of short-term market changes.

Additionally, investing the same amount each month into mutual funds or ETFs (dollar-cost averaging) smooths out market volatility and lessens the risk of mistiming your purchases. Over time, these small, steady actions yield remarkable results toward your savings goal and retirement plan.

Maximizing Employer Contributions in Your Retirement Plan

- How employer matching accelerates building retirement wealth

- Strategies to optimize contributions

Many employers match 401(k) contributions up to a certain percentage of your salary—effectively free money for building retirement wealth. Always contribute at least enough to get the maximum match. Beyond that, consider stepping up your savings rate by 1-2% each year to accelerate your path to your financial goal.

It’s wise to periodically review your contribution amounts, especially after raises or job changes. If you’re unsure how to balance retirement savings with other priorities, consult a financial advisor for tailored investment advice and ongoing support.

Diversifying Investments for Sustainable Retirement Income

- Stocks, bonds, mutual funds, and alternative assets

- The importance of revisiting your financial plan annually

Diversifying your investments means spreading your assets across stocks, bonds, mutual funds, real estate, and even alternative assets. This strategy helps protect you against market downturns and supports sustainable growth of your retirement account.

Make it a habit to revisit your financial plan and asset allocation every year. Life changes, market fluctuations, or new financial goals may require a refresh of your investment strategy. The right mix allows for stable retirement income and mitigates the risk associated with relying on a single investment vehicle.

“The best time to start building retirement wealth was yesterday. The second-best time is today.”

Common Mistakes That Derail Building Retirement Wealth

Even the best-intentioned retirement planning can go off track. Being aware of the common pitfalls can help you avoid major setbacks and keep your wealth-building journey on course.

Underestimating Lifestyle Costs in Retirement Planning

- Impact of unexpected healthcare expenses

- Importance of a flexible financial goal

One of the most frequent mistakes is underestimating the cost of healthcare and other lifestyle expenses in retirement. Emergency medical care, long-term prescription drugs, or unexpected home repairs can erode your nest egg unless your retirement plan is built with flexibility and contingency funds.

Be realistic about your monthly expenses and plan to have a buffer for rising costs or emergencies. This mindset is critical for sustaining your financial plan over decades of evolving needs.

Delaying Retirement Savings and Investment

- The high cost of waiting to start saving

- Procrastination’s effect on building wealth

Procrastination is the arch-nemesis of building wealth. Waiting even five or ten years to start saving can cut your future retirement income by more than half, forcing you to work longer or drastically reduce your lifestyle. Early, automatic saving and investing in mutual funds or a Roth IRA give your money the longest possible runway to compound and grow.

Don’t let uncertainty or analysis paralysis slow you down—starting now is the most powerful decision you can make for your retirement wealth.

Ignoring Tax Implications in Building Wealth

- The difference between taxable, tax-deferred, and tax-free retirement income

- Roth IRA and 401(k) tax strategies

Avoid potential pitfalls by planning for taxes as part of your retirement strategy. Different types of retirement income—taxable (like a brokerage account), tax-deferred (like a traditional IRA or 401(k)), and tax-free (primarily Roth IRA)—come with different rules and distribution consequences. Without a carefully mapped tax strategy, you could lose a significant portion of your nest egg to unnecessary taxes.

It's always wise to get tax advice from a qualified professional to ensure your investment advice aligns with the most efficient ways to withdraw and manage your retirement income.

People Also Ask: Your Top Retirement Wealth-Building Questions Answered

What is the $1000 a month rule for retirement?

- Explains how the $1000-a-month rule helps set financial goals for retirement

- Calculating the amount needed to generate $1000 in monthly retirement income (using the 4% rule)

The $1000-a-month rule suggests that to create $1000 in monthly retirement income, your retirement savings should total around $300,000. This is based on the 4% rule, a guideline that recommends withdrawing 4% of your savings each year. Setting this financial goal for each $1000 needed allows for clearer planning and easier tracking of your building retirement wealth progress.

How can I grow my wealth for retirement?

- Consistent saving, investing in diversified assets, and leveraging employer retirement plans are key.

- Automate savings and revisit your financial plan regularly for optimal building retirement wealth.

Begin by automating savings into a retirement account, invest wisely across multiple asset classes such as mutual funds and stocks, and contribute enough to your employer retirement plan to get the full match. As your career and financial life progress, adjust your plan with input from a financial advisor to maximize growth and adapt to new opportunities.

Is $4000 a month a good retirement income?

- $4000/month can provide a comfortable lifestyle in many regions, but adequacy depends on your personal retirement plan and expenses.

- Regularly reassess your retirement plan to ensure your building retirement wealth strategy aligns with your goals.

For many retirees, $4000 per month delivers financial comfort; the key is how well it matches your personal lifestyle and recurring expenses. Higher-cost areas or ambitious travel plans may require more, while simplicity and debt-free living can make $4000 stretch further. Reviewing your plan each year safeguards your peace of mind.

What is the 7% rule for retirement?

- The 7% rule suggests aiming for investments that average a 7% annual return, which is a widely used benchmark for building retirement wealth and forecasting long-term retirement income.

Many investment advisers encourage aiming for a long-term investment strategy with average returns near 7% per year. Achieving this rate consistently, through diversified mutual funds and careful asset management, can help you reliably build wealth and meet or exceed your long-range retirement income goals.

Actionable Steps for Building Retirement Wealth Starting Today

- Assess your current retirement savings and project future needs.

- Set a clear financial goal for retirement income.

- Choose the right mix of investments: mutual funds, Roth IRA, employer plans.

- Start saving automatically—no amount is too small.

- Integrate life insurance and Social Security into your retirement planning.

- Review and update your financial plan each year.

Frequently Asked Questions on Building Retirement Wealth

- What is the best investment strategy for building retirement wealth? A balanced strategy includes diversification among stocks, bonds, mutual funds, and tax-advantaged accounts like Roth IRA, tailored to your risk tolerance and financial goals.

- How much should I be saving monthly for my retirement plan? A common rule is 15% of your pre-tax income, but even starting smaller is better than waiting; use retirement calculators to personalize your target.

- When should I start maximizing my retirement savings contributions? The sooner, the better—especially in your 30s and 40s, and absolutely by the time catch-up contributions are allowed at age 50.

- Is life insurance necessary as part of building retirement wealth? It depends on your family situation and financial plan, but many use life insurance to protect loved ones and supplement financial security in retirement.

Key Takeaways for Anyone Serious About Building Retirement Wealth

- Early and consistent savings yield the highest results

- Integrating a financial plan, diversified investments, and tax-advantaged accounts is vital

- Adjust your retirement planning strategy as life circumstances change

Ready to Build Your Retirement Wealth? Secure Your Future by Taking the First Step Today

- Now is the time to build wealth and take control of your future.

- Explore financial planning tools, meet with a retirement planner, or enroll in an employer retirement plan. Start building retirement wealth for a more empowered tomorrow.

Video: Key Principles of Building Retirement Wealth

• Short animated explainer: How compound interest accelerates building wealth • Visual guide to Roth IRA, mutual funds, and Social Security as part of your retirement plan

Video: Common Pitfalls to Avoid in Your Retirement Planning Journey

• Expert interview on avoiding retirement saving mistakes • Real stories: The difference a disciplined financial plan makes in building wealth

Start building retirement wealth now—every day you wait is a missed opportunity for a stronger, more secure future.

If you’re committed to building a secure retirement, it’s important to think beyond just savings and investments. Exploring broader financial protection strategies, such as final expense insurance, can help ensure your loved ones are not burdened by unexpected costs down the road. For a deeper understanding of how these solutions fit into your overall wealth-building journey, discover the advantages of final expense insurance options in Ohio and how they can complement your retirement plan. Taking a holistic approach today can provide peace of mind and financial resilience for tomorrow’s uncertainties.

To further enhance your understanding of building retirement wealth, consider exploring the following resources:

- “A Financial Adviser’s Guide to Solving Your Retirement Puzzle: Five Key Pieces” ( kiplinger.com )

This guide offers crucial strategies for those approaching retirement, emphasizing that there is no one-size-fits-all solution. It outlines five key elements to effectively plan for retirement: understanding your retirement needs and lifestyle goals; identifying income sources such as Social Security, pensions, and retirement accounts; avoiding premature depletion of savings by managing withdrawal rates; creating a comprehensive financial plan to ensure lifetime savings sustainability; and maintaining a diversified portfolio that generates income in addition to growth. The article advises consultation with a certified financial professional who can tailor strategies to personal circumstances and stresses the importance of keeping tax strategies in mind to maximize funds.

- “The Three C’s to Financial Success: A Financial Planner’s Guide to Build Wealth” ( kiplinger.com )

This article emphasizes a foundational approach to building wealth that prioritizes consistency, commitment, and confidence. It argues that many individuals fail financially not due to poor strategies, but because they frequently jump between tactics without sustained effort, overlook essential tasks, or become overwhelmed by financial disorganization. Rather than seeking a universally perfect financial plan, success hinges on following a personalized plan thoughtfully and diligently. Consistency involves regular saving, strategic investing, and disciplined financial behavior over time. Commitment means staying the course through full market cycles, allowing compound interest to work over decades. Lastly, confidence in one’s financial decisions ensures persistence and reduces the likelihood of abandoning plans prematurely.

If you’re serious about building retirement wealth, these resources will provide you with comprehensive strategies and insights to develop a personalized and effective financial plan.

Add Row

Add Row  Add

Add

Write A Comment