Did you know over 60% of Americans have no estate plan or life insurance? This leaves millions of families dangerously exposed to financial risk, legal headaches, and unnecessary hardship if the unexpected happens. In this in-depth guide, you’ll uncover exactly how estate planning and insurance work hand in hand to shield the ones you love—putting you in control of your financial legacy. Whether you're just starting to consider a will or seeking to optimize a complex estate, read on to discover actionable, step-by-step ways to protect your family's future .

Why Estate Planning and Insurance are Essential for Every Family

Estate planning and insurance aren’t just for the wealthy; they’re critical safeguards for every family’s financial stability and peace of mind. Without a clear estate plan, your assets—whether it’s your home, a family business, or cherished possessions—can become tangled in probate court, often causing family disputes and lengthy delays. Even more alarming, lacking a life insurance policy may leave your loved ones struggling with lost income, outstanding debts, and looming estate taxes.

By combining estate planning with life insurance policies, you ensure immediate liquidity for beneficiaries, effectively manage estate tax exposure, and safeguard your family from unforeseen financial burdens. Failing to act could place your assets, and your family’s financial future, at unnecessary risk .

Over 60% of Americans have no estate plan or life insurance. Discover why failing to combine estate planning and insurance exposes families to unnecessary risk and financial hardship.

The Intersection of Estate Planning and Insurance: Building a Robust Estate Plan

Understanding Estate Planning and Insurance: Key Components and Benefits

At its core, estate planning is the process of organizing and managing your assets to ensure they’re distributed according to your wishes after your death. This legal process encompasses wills, trusts, power of attorney, and guardianship declarations. By articulating your intentions in official documents, you minimize confusion, reduce legal costs, and guarantee a smoother transition for your loved ones.

Insurance complements your estate plan by adding a powerful financial tool: life insurance policies can generate immediate cash when it’s needed most. This liquidity can cover final expenses, pay off debts, or provide for family members, ensuring your financial plan remains intact. A well-chosen insurance policy can also protect assets from creditors and support long-term goals such as maintaining a family business.

Definition and scope of estate planning and insurance

How insurance policies support a comprehensive estate plan

Role of Life Insurance in Modern Estate Planning

Life insurance is a cornerstone of modern estate planning, providing essential financial protection and liquidity. Its primary benefit is delivering a tax-free death benefit to your designated beneficiaries, providing immediate resources for lost income, debt payoff, and even funding a trust. By integrating a life insurance policy into your estate plan, you help ensure survivors are financially secure—regardless of the value of your tangible assets like real estate or investments.

Moreover, a well-structured life insurance policy can also be used to offset potential estate taxes. Especially for high-net-worth individuals, leveraging life insurance minimizes the risk that your heirs will have to sell assets quickly at low prices to meet tax obligations. Life insurance makes your estate plan more robust by providing both flexibility and certainty.

Protecting beneficiaries with life insurance

Using an insurance policy to manage estate tax exposure

Elements of a Solid Estate Plan: Integrating Life Insurance and Insurance Policies

A comprehensive estate plan extends beyond a simple will. It incorporates essential documents such as trusts and powers of attorney to address various scenarios and ensure your intentions are executed, even if you become incapacitated . Establishing a living will or advance directive gives your family clear instructions, sparing them from difficult decisions during emotional times.

In addition to legal documents, integrating life insurance and insurance trusts as financial safeguards is essential. An irrevocable life insurance trust (ILIT) can protect the death benefit from estate taxes, ensuring the full intended benefit reaches your heirs. These tools work together to provide comprehensive protection.

Wills, trusts, and power of attorney

Incorporating life insurance policy and insurance trust as safeguards

Types of Life Insurance for Estate Planning and Insurance Strategies

Term Life Insurance and Permanent Life Insurance: Which Should You Choose?

There are two main types of life insurance, term life insurance and permanent life insurance, that play crucial roles in estate planning strategies. Term life offers coverage for a specified period, making it ideal for temporary needs or debt payoff. Permanent life insurance remains effective for your entire lifetime and builds cash value, making it a valuable insurance policy for funding trusts and covering final estate tax expenses.

While term life is typically more affordable upfront, it doesn’t offer the long-term security permanent policies do. For most estate planning cases, permanent life insurance provides better peace of mind and greater flexibility when building long-term strategies. Before choosing, consider your family’s financial plan, overall estate size, and the duration of risk you’re seeking to cover.

Differences between term life and permanent life insurance

Analysis of cost and benefit for estate planning and insurance purposes

Using Irrevocable Life Insurance Trusts (ILIT) in Your Estate Plan

An irrevocable life insurance trust (ILIT) is a specialized estate planning tool that removes your life insurance policy from your taxable estate, helping to minimize estate tax liability. When you transfer ownership of your policy to this trust, the proceeds bypass federal estate taxes, ensuring beneficiaries receive the full death benefit. This is especially important for high-net-worth individuals whose estates may face significant tax exposure.

ILITs also provide added layers of privacy and control, allowing you to dictate how and when proceeds are distributed. You should consider an irrevocable life insurance trust if your estate nears the federal estate tax exemption threshold or if you want to ensure your death benefit is used strategically within your larger estate plan.

How an irrevocable life insurance trust shields insurance proceeds from estate taxes

When to use an irrevocable life or an irrevocable life insurance trust

Navigating Estate Taxes with Proper Estate Planning and Insurance Policy Choices

Estate Tax Exposure: How to Minimize Liability

The threat of estate taxes can significantly erode the wealth you’ve worked hard to accumulate, underscoring the importance of strategic estate planning and insurance policy selection. Fortunately, proper estate planning and the judicious use of a life insurance policy can soften—or even eliminate—this impact. For example, planning with an ILIT ensures death benefits are not subject to federal estate tax while providing immediate liquidity to pay any outstanding taxes or debts.

Work closely with a tax advisor and an estate planning attorney to coordinate your estate plan and insurance policies effectively. Strategies may include leveraging annual gift exclusions, establishing trusts, and selecting insurance policies tailored to your unique family dynamics and estate value. Don’t neglect the state estate taxes, which may apply even if your estate is under the federal threshold.

Leveraging life insurance to cover estate tax obligations

Addressing federal and state estate taxes through coordinated estate planning

The 5 and 5 Rule: How it Affects Trusts and Estate Plans

The “5 and 5 rule” in estate planning limits beneficiaries to withdrawing either $5,000 or 5% of trust principal, whichever is greater, each year. This provision prevents large, immediate withdrawals that might trigger federal gift tax consequences while preserving the trust’s primary purpose—long-term stewardship of assets.

Consult with a tax advisor or estate planning attorney to understand if and how this rule affects your estate plan or family trust structure. For families concerned about future estate tax bills or the responsible transfer of intergenerational wealth, the 5 and 5 rule provides an effective framework for structured distributions.

Detailed explanation of the 5 and 5 rule

Tax advisor insights on its effect on distributions and taxes

How to Choose the Right Insurance Policies for Estate Planning and Insurance Success

Comparing Types of Life Insurance Policies for Estate Planning

Type |

Term Life |

Whole Life |

Universal Life |

|---|---|---|---|

Coverage Duration |

10-30 years |

Lifetime |

Flexible lifetime |

Premium Cost |

Lower |

Higher |

Varies (flexible) |

Cash Value |

No |

Yes |

Yes |

Estate Planning Role |

Temporary needs, debt payoff |

Long-term estate planning, trust funding |

Flexible trusts, wealth transfer |

Pros |

Cost-effective, simple |

Guaranteed death benefit, savings component |

Adjustable premiums, flexible |

Cons |

Expires, no savings |

Expensive, less flexible |

Requires monitoring, variable |

Working with Professionals: Tax Advisor, Estate Planning Attorney, and Insurance Agent

The complexity of estate planning and insurance policies is best managed by assembling a team of experts, including a tax advisor, estate planning attorney, and insurance agent. A tax advisor ensures you maximize tax benefits and minimize exposure. An estate planning attorney creates legal structures that stand up under scrutiny. An insurance agent guides you through the maze of insurance company offerings, tailoring policies to fit your unique needs and goals.

The best outcomes come from collaborative efforts—case studies show that families who rely on coordinated advice experience fewer mistakes and achieve their estate plan objectives more consistently. Do not underestimate the value of professional legal and financial advice .

The value of coordinated advice for estate planning and insurance

Case studies featuring collaborative approaches

Overcoming Common Disadvantages and Pitfalls in Estate Planning and Insurance

Avoiding the Most Common Estate Planning Mistakes

Many people create a will or purchase life insurance policies and then neglect updates—but life changes, so regular reviews of your estate plan and insurance policies are essential. Regular reviews and updates are vital to ensure all documents still reflect your wishes and changing circumstances. Failing to update beneficiaries or ignoring new asset acquisitions can undermine your entire financial plan.

Another frequent error is overlooking the value of an insurance trust or life insurance trust. These specialized estate planning tools provide added protection against creditors and estate tax while streamlining the distribution of assets to your family members. Stay proactive and revisit your documents after major life milestones such as marriage, divorce, or the arrival of new family members.

Lack of regular reviews and updates

Overlooking the utility of insurance trust and life insurance trust

Disadvantages Every Estate Plan Owner Should Know

No solution is perfect. Estate plans may encounter probate delays if not structured correctly. Certain types of life insurance might not effectively align with your estate planning objectives, especially if your beneficiaries or overall goals change. It’s also easy to miss nuances like proper trust titling or naming the right insurance policy owner.

Some insurance policies come with limitations—cash value growth potential, ongoing fees, or the possibility of lost income for family members if policies lapse. Maintaining open communication and regular review with a financial plan professional will help expose and address these pitfalls before they become costly issues.

Potential probate issues

Misalignment between insurance policies and estate plan objectives

Limitations in certain types of life insurance

Practical Steps to Create and Update Your Estate Planning and Insurance Documents

Take inventory of all assets, liabilities, and existing insurance policies. This step ensures nothing is overlooked—real estate, businesses, bank accounts, retirement plans, and possessions all count.

Assess whether your insurance policies provide sufficient coverage for current and future obligations, such as replacing lost income and covering estate tax and income tax liabilities.

Establish or update critical documents: will, trust, powers of attorney, healthcare directives, and beneficiary designations.

Consult a tax advisor and estate planning attorney to review your strategy and ensure complete alignment between estate planning and insurance documents.

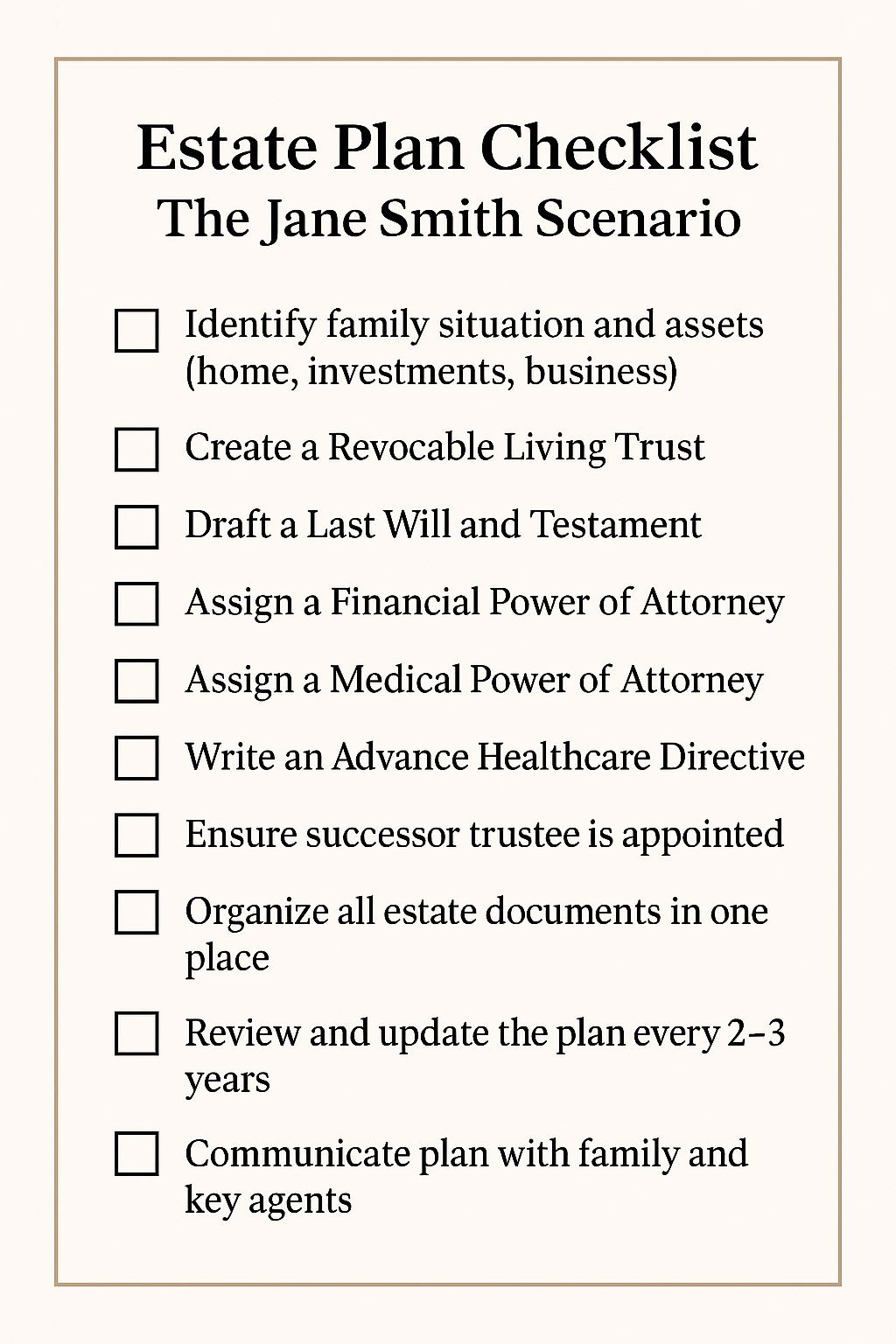

Checklist for Updating Estate Plans and Insurance Policies

Key life events requiring updates

Integrating new insurance policy options for evolving estate needs

Major milestones—marriages, divorces, the birth of children, significant changes in assets, or new business ventures—should always prompt a review of both your estate plan and insurance documents. Proactively integrating new insurance policy options assures your plan remains resilient and responsive to life's changes.

Stories and Lessons: Real-Life Examples of Effective Estate Planning and Insurance

“My family avoided significant estate taxes because we established an irrevocable life insurance trust—now my children are financially secure.”

Profiles of families who benefited from strategic estate planning and insurance

Common pitfalls exposed by real-world case studies

One family, after consulting a tax professional and setting up an ILIT, preserved their vacation home and ensured uninterrupted support for elderly parents and minor children. In another example, a small business owner’s oversight over beneficiary designations led to an accidental split of proceeds—a cautionary tale about why regular reviews are key. Learning from these practical cases empowers you to avoid missteps as you protect your own legacy.

Video: Expert Discussion on Estate Planning and Insurance Essentials

A visual tutorial from a certified estate planning attorney and insurance specialist reviewing core principles and best practices.

Watch how experts break down estate planning and insurance essentials, explaining complex concepts in everyday terms. Learn tips for trust setup, estate tax reduction, and integrating insurance into your estate plan for maximum protection.

People Also Ask About Estate Planning and Insurance

Is insurance part of estate planning?

Answer: Yes, insurance—especially life insurance—is a critical component of a comprehensive estate plan because it helps provide immediate liquidity for heirs, protects assets from creditors, and can be leveraged to pay estate taxes or fund trusts.

What are the disadvantages of estate planning?

Answer: Estate planning may involve upfront costs, complex legal processes, and regular maintenance. Some trusts or insurance policies may incur ongoing fees and require professional management.

What is the 5 and 5 rule in estate planning?

Answer: The 5 and 5 rule limits annual trust distributions by allowing beneficiaries to withdraw the greater of $5,000 or 5% of trust principal each year without triggering federal gift tax consequences.

What type of life insurance is best for estate planning?

Answer: Permanent life insurance (whole or universal) is typically best for long-term estate planning since the coverage lasts a lifetime and can be used to fund trusts or cover estate taxes.

Comparing Estate Planning and Insurance Tools

Tool |

Will |

Revocable Trust |

Irrevocable Trust |

Term Life |

Whole Life |

Universal Life |

|---|---|---|---|---|---|---|

Main Benefit |

Asset transfer, guardianship |

Avoid probate, flexible |

Tax protection, asset shield |

Inexpensive coverage |

Lifetime coverage, savings |

Flexible coverage, premium |

Probate Avoidance |

No |

Yes |

Yes |

N/A |

N/A |

N/A |

Estate Tax Benefits |

Limited |

Some |

High |

None |

Yes |

Yes |

Death Benefit |

No |

No |

No |

Yes |

Yes |

Yes |

Flexibility |

Limited |

High |

Low once funded |

Low |

Medium |

High |

Checklist: Essential Tasks for Estate Planning and Insurance Maintenance

Annual review of estate plan and insurance policies

Update beneficiaries and asset inventory

Consult a tax advisor or estate planning attorney for significant life changes

Key Takeaways and Best Practices for Estate Planning and Insurance

Integrate life insurance with other estate planning documents

Understand the impact of estate tax on your legacy

Update your estate plan and insurance policies regularly

Frequently Asked Questions About Estate Planning and Insurance

What is an irrevocable life insurance trust? An irrevocable life insurance trust (ILIT) is a legal entity that owns your life insurance policy, removing the death benefit from your taxable estate and allowing you to direct how benefits are distributed to heirs.

How do insurance trust and life insurance trust benefit high-net-worth individuals? They shield policy proceeds from estate taxes, protect assets from creditors, and give greater control over the timing and conditions of asset distributions to beneficiaries.

Can you use term life insurance in estate plans? Yes, but it is generally best for temporary needs such as paying off a mortgage, not for long-term wealth transfer or tax planning.

How do you select beneficiaries for insurance policies in your estate plan? Select beneficiaries based on your family circumstances, long-term goals, and the tax implications for each. Always coordinate beneficiary designations across your estate plan to avoid conflicts or unintended outcomes.

Further Learning: Video Guide to Maximizing Your Estate Planning and Insurance

Video walkthrough of an estate plan scenario demonstrating strategic insurance policy use and estate tax reduction.

Final Thoughts: Secure Your Legacy with Effective Estate Planning and Insurance

CHECKLIST

Protect your loved ones by combining estate planning and insurance. Take control of your financial future today—consult an attorney or financial advisor for bespoke solutions.

Visual Guide: Infographic Video on Estate Planning and Insurance Essentials

Short educational animation summarizing core points and actionable steps to begin your estate planning and insurance journey.

Incorporating life insurance into your estate plan is a strategic move to ensure your family’s financial security and to manage potential estate taxes effectively. The article “Should You Add Life Insurance to Your Estate Plan?” by Charles Schwab provides valuable insights into how life insurance can serve as a tool to pay estate taxes, eliminate inheritance inequities, and provide for heirs with disabilities. ( schwab.com ) Additionally, “10 Uses of Life Insurance in Estate Planning” by Ameritas outlines various ways life insurance can be utilized, such as income replacement, funding estate taxes, and creating an inheritance for heirs. ( ameritas.com ) If you’re serious about securing your family’s future and optimizing your estate plan, these resources offer comprehensive guidance to help you make informed decisions.

Add Row

Add Row  Add

Add

Write A Comment