Did you know that nearly 60% of Americans don't take full advantage of the cash value potential in their permanent life insurance? Imagine being in the minority—those who turn the often-overlooked IUL cash value into a flexible, robust savings engine while protecting their loved ones. In this comprehensive guide, you'll discover how to harness the unique benefits of indexed universal life insurance (IUL), unlocking strategies for steady savings growth, risk protection, and long-term financial confidence.

Understanding IUL Cash Value and How It Impacts Your Savings

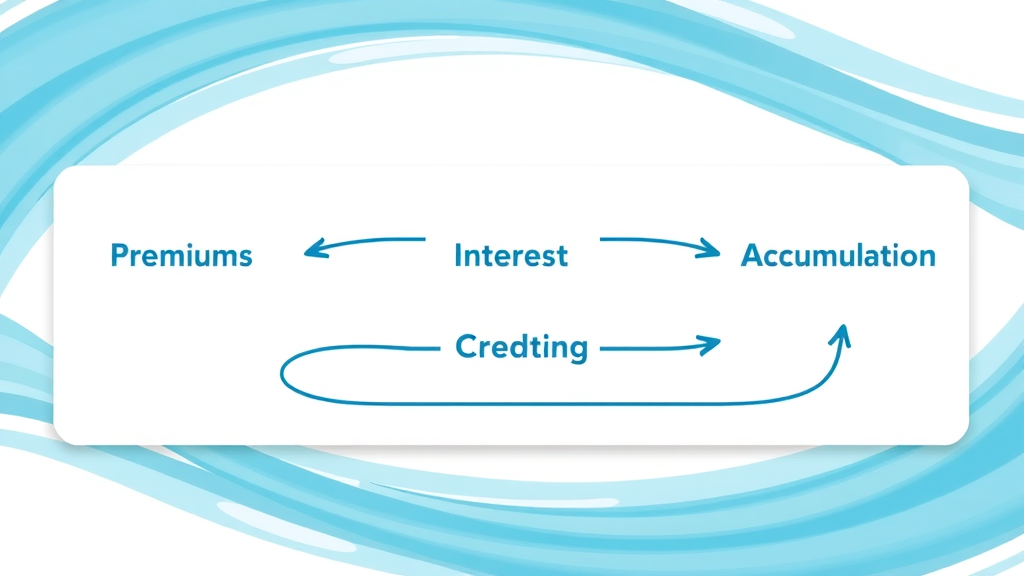

The IUL cash value is the heart of an indexed universal life insurance policy—a savings engine tucked inside your life insurance coverage. When you pay premiums into an IUL policy, a portion goes toward providing your death benefit, while the remainder is funneled into a cash value account that accumulates over time. This valuable account earns interest based on the performance of a market index , such as the S&P 500, rather than being directly tied to the ups and downs of the stock market itself. This structure allows your savings to grow more steadily, with built-in protection against market downturns through features like interest rate floors.

For many individuals, the cash value component of their IUL policy offers a rare combination of flexible savings growth, protection from major loss, and access to funds should unexpected needs arise. Unlike other forms of permanent life insurance, such as whole life or standard universal life, an IUL typically allows for higher growth potential and greater policy flexibility. This means your policy adapts as your goals or financial situation change, making it ideal for worry-free, long-term planning.

Understanding how IUL cash value works—and the factors that influence its growth—is key for anyone looking to optimize savings within their universal life insurance policy . Practical examples are everywhere: families saving for college, retirees seeking supplemental income, or business owners needing liquidity. By mastering the mechanics and opportunities of IUL, your cash value grow can be both confident and substantial.

"Did you know that nearly 60% of Americans don't take full advantage of the cash value potential in their permanent life insurance? Discover how IUL cash value can change your financial future."

What You'll Gain from Mastering IUL Cash Value

- The essentials of IUL cash value and its benefits

- How indexed universal life insurance builds long-term growth

- Comparison of IUL cash value with other universal life insurance types

- Steps to maximize the growth of your IUL policy

What Is IUL Cash Value and How Does It Work in Universal Life Insurance?

Defining IUL Cash Value in the Context of Life Insurance

IUL cash value refers to the accumulating savings portion within an indexed universal life insurance policy . Unlike term life policies that only offer a death benefit for a fixed period, IUL and other permanent life insurance solutions include a savings account, which is funded by a portion of your premium payments. This cash value has the unique advantage of potentially growing as the market index performs, all while being sheltered from direct stock market volatility.

As you pay premiums into your IUL policy , the insurance company allocates enough funds to cover the cost of insurance (ensuring your loved ones receive the agreed death benefit if needed). The rest goes into the cash value account—where it not only earns interest , but continues to grow tax-deferred. Over time, this can lead to substantial cash value grow —a powerful supplement for retirement funding, emergency needs, or legacy planning. The flexibility of accessing these funds through policy loans or partial withdrawals allows IUL policyholders to shape their life insurance as a personalized savings plan.

Core Mechanics: How Indexed Universal Life Insurance Policies Grow Cash Value

The growth engine behind an IUL policy lies in its indexing strategy. The cash value portion is credited with interest based on the performance of a selected stock market index , such as the S&P 500. But unlike direct market investments, your cash value can never earn a negative return—even if the relevant index posts a loss. Most IUL insurance policies include a guaranteed minimum interest rate floor (often around 0-1%), ensuring your cash value never declines due to a poor market year.

(Insurance company) credits each policy's cash value annually, based on how well the chosen market index performs, up to a certain ceiling or "cap rate." There's also a "participation rate," which determines what percentage of market gains are credited to your account. For example, a cap rate of 10% and a participation rate of 80% would allow your cash value to grow up to 8% in a year the index rises 10% or more. Importantly, while you benefit from market ups, losses will not erode your accumulated savings. This powerful structure balances opportunity with downside protection, making IUL a favored choice in the universal life insurance category.

Comparing IUL Cash Value to Other Universal Life Insurance Options

| Policy Type | Growth Mechanism | Guaranteed Interest? | Flexibility | Market Risk |

|---|---|---|---|---|

| IUL Cash Value | Linked to market index (cap and participation rates) | Yes (minimum floor) | Very flexible premiums, adjustable death benefit | No direct market risk |

| Universal Life Insurance | Fixed interest rate set by the insurer | Yes (minimum interest rate) | Flexible premiums, adjustable death benefit | No direct market risk |

| Whole Life Insurance | Insurer dividends, fixed interest | Yes (guaranteed cash value accumulation) | Little flexibility | No |

Indexed Universal Life vs. Universal Life: Key Differences in Cash Value Growth

When comparing IUL cash value to traditional universal life insurance policies, the main difference lies in the way your funds grow. Universal life insurance offers a fixed interest rate—set by the insurance company—so cash value growth can be predictable but often limited. Meanwhile, IUL insurance utilizes an indexing method, which gives your savings the potential to outperform fixed-rate policies when markets are strong, yet still shields your principal during down years.

This makes IUL policies particularly attractive for those wanting the potential for higher cash value grow without risking their accumulated savings. With adjustable premiums and options to alter the death benefit, indexed universal life is highly adaptable. Still, both options allow for policy loans and withdrawals, offering flexibility in financial planning.

Indexed Universal Life Insurance vs. Whole Life Insurance Policies

While both indexed universal life insurance and whole life insurance are considered permanent life insurance, their approaches to building cash value differ greatly. Whole life policies accumulate cash value at a guaranteed rate, based on a fixed schedule and sometimes enhanced with company dividends. This conservative approach is ideal for risk-averse individuals seeking slow and steady growth.

In contrast, IUL cash value is linked to the chosen market index's performance (subject to caps and floors), giving the policyholder a chance at greater growth without direct stock market exposure. Thus, IUL insurance is a favored option for those looking for a blend of opportunity, moderate security, and flexibility. Knowing these distinctions helps you select the policy type that fits your needs, risk tolerance, and savings ambitions best.

Benefits and Limitations of IUL Cash Value in Life Insurance Policies

- Tax-advantaged growth potential

- Flexible premium payments in indexed universal policies

- Market participation with downside protection

- Potential fees and cap rates in universal life insurance policies

One of the most appealing aspects of IUL cash value is the tax-deferred nature of its growth. As your cash value grows, you won’t owe taxes on the gains until you withdraw funds or surrender the policy. This advantage, along with the ability to adjust premium payments and death benefits, makes indexed universal life policies incredibly versatile. Whether life events change or the markets shift, your IUL policy can adapt accordingly, providing peace of mind.

However, IUL insurance does come with certain limitations. Policy fees, including administrative costs and charges for the cost of insurance, can sometimes reduce your net returns. Additionally, cap and participation rates—set by the insurance company—can limit the maximum credited interest during strong market years. Making the most of your policy requires monitoring these elements and periodically reviewing your plan with a knowledgeable financial advisor .

How to Maximize the Growth of IUL Cash Value in Your Life Insurance Policy

Understanding Interest Rate and Participation Rate in an IUL Policy

The interest rate credited to your IUL cash value relies heavily on two factors: the participation rate and the cap rate. The participation rate is the percentage of the market index’s performance that is actually credited to your policy—if the index earns 12% and your participation rate is 80%, your cash value will be credited 9.6%. Similarly, the cap rate is the maximum rate of interest that can be credited, regardless of how well the index performs. Understanding these two elements is crucial, because they define the upper and lower boundaries of your cash value growth each year within an IUL insurance policy .

Some indexed universal life policies also guarantee a minimum interest rate. In years when the index performs poorly, this floor ensures you won’t lose principal, though growth may slow. By regularly checking current participation and cap rates—since insurance companies can adjust them over time—you can make educated decisions about additional premium contributions or policy adjustments.

Practical Steps to Make Your IUL Policy's Cash Value Grow Faster

- Increase premium contributions

- Monitor cap and participation rates

- Adjust allocations regularly

- Minimize policy loans early on

Maximizing cash value grow starts with consistently funding your IUL policy at a higher premium. More money in your policy early on means greater potential for compounded growth over time. Next, regularly monitor your IUL policy’s participation and cap rates to ensure you’re getting the best return possible. Adjust allocations if your policy offers index choices, and minimize taking loans or withdrawals in the policy’s early years. Consulting your financial advisor annually can help you pivot as markets and your personal needs change, ensuring optimal results from your indexed universal life insurance .

Critical Elements That Affect IUL Cash Value Growth in Insurance Policies

Market Index Performance and Policy Credit Limits in Indexed Universal Life Insurance

The performance of your chosen market index is the primary driver behind the credited interest in your IUL cash value . Strong index performance can accelerate savings build-up, especially when cap and participation rates are favorable. However, since your policy is not directly invested in the stock market index , you’re insulated from negative years. Your policy’s credited interest will never dip below the contractually agreed minimum, though in flat or down markets, growth may plateau.

It’s also important to note that indexed universal life insurance providers reserve the right to adjust cap rates and participation rates at set intervals. Understanding your policy’s benchmark index, and keeping an eye on annual interest crediting statements, will help you forecast future cash value accumulation and adapt your premium payments or investment strategy accordingly.

The Role of Interest Rate Floors and Caps in Universal Life Insurance Policy

Most universal life insurance policies , especially IULs, include an interest rate floor—ensuring you never lose principal due to negative index performance. Typical floors range from 0% to 1%, guaranteeing that your cash value always moves forward, albeit sometimes slowly. On the flip side, cap rates restrict how much credited growth can occur in especially strong index years, effectively setting a ceiling to prevent excessive liability for the insurance company.

The interplay between these floors and caps is at the heart of IUL’s design: you participate in positive index years—often with robust policy growth—while being cushioned from market downturns. This setup is ideal for individuals who desire protection but are still eager for upside in their long-term savings.

Real-World Examples: How IUL Cash Value Performs in Universal Life Insurance Policies

- Case study: IUL cash value in a $250,000 policy

- Case study: Indexed universal life insurance for retirees

- Scenario analysis: Handling market volatility with IUL insurance policies

Consider this example: Emily, age 35, purchases an IUL policy with a $250,000 death benefit. By overfunding premiums in the first 10 years, she lets her cash value benefit from solid index performance with no risk of principal loss. By age 55, the cash value component has grown enough for Emily to begin taking policy loans to supplement her retirement income—tax-free—while still maintaining life insurance coverage for her heirs.

In another real-world case, a retiree uses the flexible premium feature of their IUL to decrease payments in lean years, while still allowing the cash value to earn interest and guard against market drops. During periods of volatility, their policy’s floor rate ensures they lose nothing, even when the stock market struggles.

These examples illustrate the versatility of IUL insurance policies: whether growing funds aggressively or seeking safe harbor from market swings, the IUL’s structure can be tailored to nearly any financial scenario.

"IUL policies offer a unique blend of protection and opportunity for cash value growth—without the direct risks of the stock market."

Frequently Asked Questions About IUL Cash Value and Life Insurance Policies

How Safe Is the Cash Value in an IUL Insurance Policy?

IUL cash value is protected by a contractual interest rate floor, meaning it cannot decrease due to negative market index performance. However, policy fees and loans can reduce your cash value. As long as premiums are paid and loans managed responsibly, the cash value in an IUL insurance policy is considered one of the safer savings vehicles among permanent insurance options.

Can You Withdraw Your IUL Cash Value Anytime?

Yes, policyholders can access the IUL cash value through policy loans or partial withdrawals. However, withdrawals can decrease the policy's death benefit and may incur surrender charges, especially during the first years. It's best to plan withdrawals with your financial advisor to avoid tax consequences and preserve the integrity of your life insurance policy .

What Are the Risks and Pitfalls of IUL Cash Value in Life Insurance?

The main risks come from over-borrowing against your policy or underfunding premiums, which can cause the insurance policy to lapse. Fees (administrative, cost-of-insurance, etc.) can also eat into returns if not managed wisely. Finally, fluctuations in cap and participation rates can limit growth, so ongoing reviews are essential.

Exploring the Flexibility of IUL Cash Value in Universal Life Insurance

Adjusting Premiums and Death Benefit within Indexed Universal Life Insurance

One of the defining features of an IUL insurance policy is the flexibility it grants in adjusting both premium contributions and the policy’s death benefit. As life events unfold—such as income changes, marriage, or retirement—you can increase or decrease your payments to keep the policy aligned with your goals. Increasing the death benefit can provide more protection, while lowering premiums may free up cash flow in leaner times.

This adaptability is a primary advantage over traditional life insurance policies, making IUL a premier choice for families and individuals with changing needs. Remember that changes may affect the policy’s internal charges or long-term cash value accumulation, so always consult with a qualified financial advisor before making adjustments.

Accessing Cash Value through Policy Loans

Taking a loan against your IUL cash value lets you access funds for any purpose—tuition, emergencies, or supplemental retirement—without tax consequences, provided the policy remains in force. Loan interest rates are typically lower than unsecured lines of credit, and repayment is flexible. The key is to avoid allowing the policy to lapse with an outstanding loan balance, as doing so could create an unintended tax bill and reduce the death benefit.

Why Choose IUL Cash Value for Long-Term Savings in Life Insurance Policies?

- Comparison with other permanent life policies

- Strategies for wealth building with cash value grow

- Legacy planning through life insurance policies

Choosing an IUL policy for long-term savings means investing in a vehicle that combines security, flexibility, and powerful tax advantages. Compared with whole life or standard universal life, an indexed universal life policy provides a higher long-term growth ceiling through market-linked interest while still safeguarding your principal.

Many wealth-building strategies center on periodically funding your policy above the minimum required premium, allowing the cash value component to expand quickly in strong years. This approach also dovetails perfectly with legacy planning, as IUL policies seamlessly pass a death benefit to heirs while providing access to savings during your lifetime.

"Wealthy individuals are increasingly leveraging IUL cash value as a cornerstone for generational wealth and financial flexibility."

Key Criteria for Evaluating IUL Policies and Maximizing Cash Value

- Company reputation and history with indexed universal life

- Fine print: policy fees, cap rates, and crediting methods

- Customer reviews and satisfaction with universal life insurance policies

When shopping for the right indexed universal life insurance policy, consider the strength and reputation of the insurance company, as well as its history of maintaining competitive cap and participation rates. Dive into the fine print on policy fees—these can vary and impact long-term cash value grow . Finally, research independent customer reviews to gauge satisfaction and support should you ever need to make changes to your plan.

Expert Tips for Using IUL Cash Value to Secure Your Financial Future

- Consult with a licensed financial advisor experienced in life insurance and universal policies

- Regular policy reviews to optimize growth of IUL cash value

- Integrate IUL insurance into a diversified savings plan

Consider partnering with a seasoned financial advisor for ongoing guidance on your IUL policy . They can help you make the most of policy reviews, spot new growth opportunities, and even integrate your IUL insurance into a comprehensive financial plan that includes diversified investments. Regular checkups are key for adjusting funding levels and reallocating to optimize your cash value’s growth potential.

What happens to cash value in IUL?

When you surrender or withdraw from your indexed universal life insurance policy, the cash value you've accumulated may be distributed according to your provider's terms. If you pass away, IUL cash value typically goes toward the death benefit payout, not directly as an additional payout to beneficiaries.

What is the cash value of a $10,000 whole life insurance policy?

The cash value of a $10,000 whole life insurance policy depends on several factors, including age, premium payments, and how long the policy has been active. Usually, cash value accumulates slowly in early years and grows more rapidly after 10-15 years, potentially reaching several thousand dollars over time.

Why do rich people use IUL?

High-net-worth individuals utilize IUL cash value because it allows for tax-advantaged growth, flexible access to funds, and integrated estate planning strategies. The combination of a permanent death benefit and the ability to let cash value grow outside of traditional investments makes IUL insurance appealing.

What is the cash value of a $30,000 whole life insurance policy?

As with a $10,000 policy, the cash value of a $30,000 whole life insurance policy is influenced by the length of time you’ve paid premiums, the interest credited, and policy fees. After decades, you might see significant accumulation, often reaching a third or half of the policy’s face value in later years.

Summary: Take Charge of Your Future by Harnessing IUL Cash Value

- IUL cash value is a powerful, tax-advantaged way to save

- Properly managed, indexed universal life insurance offers flexibility and growth

- Consult an expert to optimize your life insurance policies for maximum benefit

"Harness the full power of your savings and provide security for your loved ones—explore IUL cash value options today!"

Frequently Asked Questions on IUL Cash Value and Universal Life Insurance

Are IUL policies better than whole life for cash value growth?

IUL policies typically offer more potential for cash value grow than whole life policies, due to participation in market index performance. However, whole life offers steadier, guaranteed growth. The right choice depends on your risk tolerance and financial goals.

How do participation rates affect my IUL cash value?

The participation rate determines what portion of the index’s gains are credited to your IUL. Higher participation rates mean more growth when the market is up, so it’s important to monitor and understand how your insurer sets and adjusts this number.

Is my IUL cash value protected during a market downturn?

Yes. Thanks to the policy’s interest rate floor, your IUL cash value is protected from losses during negative years in the underlying index. Your savings may not grow, but they won't shrink due to market downturns.

Should I use my IUL cash value for retirement?

While IUL insurance is not a replacement for traditional retirement accounts, its cash value can serve as a flexible, tax-advantaged source of supplemental income. Many retirees use policy loans or withdrawals to enhance their retirement cash flow.

Take action now: Leverage the strength of IUL cash value in your financial plan and consult a licensed financial advisor to tap the full potential of indexed universal life insurance for your future security.

Indexed Universal Life (IUL) insurance offers a unique blend of life coverage and cash value accumulation, making it a versatile financial tool. The article “Indexed Universal Life Insurance Explained (IUL Insurance)” provides a comprehensive overview of how IUL policies function, detailing the mechanics of cash value growth linked to market indices and the flexibility they offer in premium payments and death benefits. ( forbes.com ) Additionally, “Indexed Universal Life Insurance | Bankrate” delves into the specifics of cash value components, explaining concepts like cap rates, floors, and participation rates, which are crucial for understanding potential returns and protections against market downturns. ( bankrate.com ) For those seeking to maximize wealth through IUL policies, “IUL Policies to Maximize Wealth: Tax-Free Income & Guaranteed Growth 2025” offers insights into strategies for tax-free income and guaranteed growth, highlighting the benefits of overloan protection and the importance of understanding policy loans and withdrawals. ( ogletreefinancial.com ) If you’re serious about leveraging IUL cash value for financial growth and security, these resources will provide you with the essential knowledge and strategies to make informed decisions.

Add Row

Add Row  Add

Add

Add Row

Add Row

Add

Add

Write A Comment